Can You Have A Homestead Exemption On Two Homes . Here, learn how to claim a homestead. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web you can't get a residence homestead exemption on a second home or vacation home. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web homestead exemptions can help lower the property taxes on your home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's.

from yourrealtorforlifervictoriapeterson.com

Web you can't get a residence homestead exemption on a second home or vacation home. Web homestead exemptions can help lower the property taxes on your home. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Here, learn how to claim a homestead. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that.

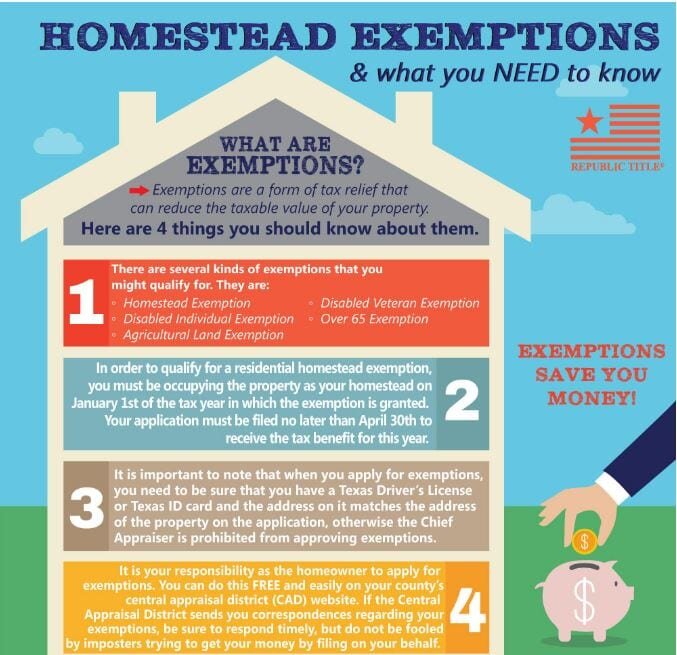

Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Can You Have A Homestead Exemption On Two Homes Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Here, learn how to claim a homestead. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web you can't get a residence homestead exemption on a second home or vacation home. Web homestead exemptions can help lower the property taxes on your home. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income.

From www.northatlantarealestatevoice.com

What is Property Tax Homestead Exemption in Can You Have A Homestead Exemption On Two Homes Web homestead exemptions can help lower the property taxes on your home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Here, learn how to claim a homestead. Web you can't get a residence homestead exemption on a second home or vacation home. Web the texas homestead exemption. Can You Have A Homestead Exemption On Two Homes.

From www.pinterest.com

What Is A Homestead Exemption? Homesteading Simple Self Sufficient Can You Have A Homestead Exemption On Two Homes Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the. Can You Have A Homestead Exemption On Two Homes.

From www.pinterest.com

What is a Homestead Exemption? Home buying, Home decor, Decor Can You Have A Homestead Exemption On Two Homes Here, learn how to claim a homestead. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web you can't get a residence homestead exemption on a second home or vacation home. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web. Can You Have A Homestead Exemption On Two Homes.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Can You Have A Homestead Exemption On Two Homes Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Here, learn how to claim a homestead. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web homestead exemptions cannot typically be. Can You Have A Homestead Exemption On Two Homes.

From blog.squaredeal.tax

How much does Homestead Exemption save in Texas? Square Deal Blog Can You Have A Homestead Exemption On Two Homes Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of. Can You Have A Homestead Exemption On Two Homes.

From www.exemptform.com

Example Of Homestead Declaration Certify Letter Can You Have A Homestead Exemption On Two Homes Web you can't get a residence homestead exemption on a second home or vacation home. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web homestead. Can You Have A Homestead Exemption On Two Homes.

From www.exemptform.com

Fillable Form Dte 105i Homestead Exemption Application For Disabled Can You Have A Homestead Exemption On Two Homes Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web you can't get a residence homestead exemption on a second home or vacation home. Web a homestead exemption is a legal provision that shields. Can You Have A Homestead Exemption On Two Homes.

From www.epgdlaw.com

How do I Claim the Florida Homestead Exemption? EPGD Business Law Can You Have A Homestead Exemption On Two Homes Web homestead exemptions can help lower the property taxes on your home. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web you can't get a residence homestead exemption on a second home or vacation home. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each. Can You Have A Homestead Exemption On Two Homes.

From www.rusticaly.com

What States Have Homestead Exemption? Clearly Explained! Can You Have A Homestead Exemption On Two Homes Web you can't get a residence homestead exemption on a second home or vacation home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web. Can You Have A Homestead Exemption On Two Homes.

From www.hauseit.com

What Is the FL Save Our Homes Property Tax Exemption? Can You Have A Homestead Exemption On Two Homes Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web you can't get a residence homestead exemption on a second home or vacation home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Here,. Can You Have A Homestead Exemption On Two Homes.

From www.christybuckteam.com

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team Can You Have A Homestead Exemption On Two Homes Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Here, learn how. Can You Have A Homestead Exemption On Two Homes.

From www.pinterest.com

Under Florida Statute §222.01, a debtor who files bankruptcy is allowed Can You Have A Homestead Exemption On Two Homes Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web the texas homestead exemption is a tax break that allows you to exclude up to. Can You Have A Homestead Exemption On Two Homes.

From texastitle.com

Homestead Exemption 6 Things To Know Before You File Texas Title Can You Have A Homestead Exemption On Two Homes Web homestead exemptions can help lower the property taxes on your home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web the texas homestead. Can You Have A Homestead Exemption On Two Homes.

From cedarparktxliving.com

Texas Homestead Tax Exemption Cedar Park Texas Living Can You Have A Homestead Exemption On Two Homes Web a homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner's spouse or. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web homestead exemptions cannot typically be claimed on commercial properties, second. Can You Have A Homestead Exemption On Two Homes.

From www.exemptform.com

Bartow County Ga Homestead Exemption Form Can You Have A Homestead Exemption On Two Homes Web homestead exemptions can help lower the property taxes on your home. Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web. Can You Have A Homestead Exemption On Two Homes.

From www.stiverfirst.com

File for Homestead Exemptions… Rotonda West and Englewood Real Estate Can You Have A Homestead Exemption On Two Homes Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web homestead exemptions can help lower the property taxes on your home. Web homestead exemptions cannot typically be claimed. Can You Have A Homestead Exemption On Two Homes.

From www.exemptform.com

Application For Nueces Residence Homestead Exemption Fill Online Can You Have A Homestead Exemption On Two Homes Web if you have homes in two states, you are still permitted only one homestead exemption, as the law understands that. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web the texas homestead exemption is a tax break that allows you to exclude up to $100,000 of your home's. Web section 11.13 (h) of. Can You Have A Homestead Exemption On Two Homes.

From www.exemptform.com

County Indiana Homestead Exemption Form Can You Have A Homestead Exemption On Two Homes Web homestead exemptions can help lower the property taxes on your home. Web homestead exemptions cannot typically be claimed on commercial properties, second homes or income. Web section 11.13 (h) of the texas tax code states that unmarried, joint owners of a home cannot each receive a homestead exemption for the same. Web if you have homes in two states,. Can You Have A Homestead Exemption On Two Homes.